Medicare Financial Challenges: How Seniors Can Adjust Their Retirement Plans to Ensure Worry-Free Healthcare

As people age, ensuring access to healthcare becomes one of their most pressing concerns. For many seniors, Medicare plays a vital role in providing health coverage, but recent financial challenges have put the program’s stability at risk. In light of these financial difficulties, it’s more important than ever for seniors to adjust their retirement plans to ensure that they have access to the healthcare services they need without financial worry. In this article, we’ll explore the financial challenges Medicare faces, key factors seniors should consider in their retirement planning, and practical strategies to adjust their plans to safeguard their healthcare future.

The Financial Challenges Facing Medicare

Medicare, the federal health insurance program for people aged 65 and older, faces significant financial challenges. These challenges stem largely from an aging population and the rising cost of healthcare services. With baby boomers reaching retirement age, the number of Medicare beneficiaries is increasing, putting pressure on the program's funding. Additionally, the cost of medical treatments and prescription drugs continues to rise, further straining Medicare’s resources.

As a result, there are concerns about Medicare’s long-term sustainability. According to projections, Medicare's trust fund will face depletion in the coming years, which could lead to reduced benefits for recipients. These financial challenges mean that seniors must be proactive in their retirement planning, ensuring they have additional resources to cover healthcare costs that Medicare may not fully address.

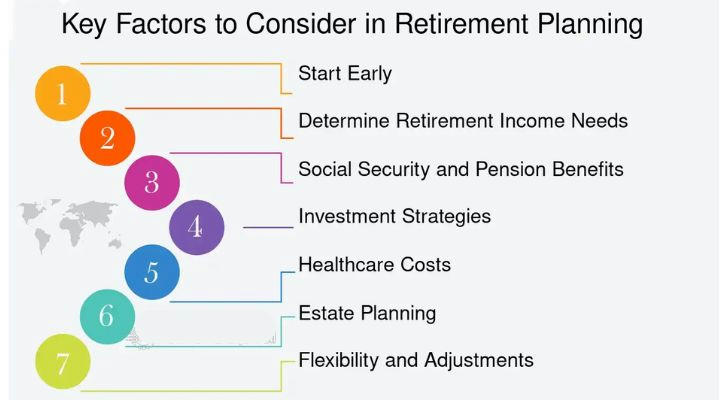

Key Factors Seniors Need to Consider in Their Retirement Plans

As you approach retirement, it's essential to understand how healthcare needs may evolve and how to plan for them. Here are some key factors that seniors should consider when adjusting their retirement plans:

1.The Growing Need for Healthcare

As you age, your healthcare needs will likely increase. Chronic conditions, surgeries, and medical treatments become more common, meaning that the cost of healthcare will likely rise. Even with Medicare, there are still many out-of-pocket costs for medical services that aren’t covered by the program, such as dental, vision, and long-term care.

2.Medicare and Supplemental Insurance

Medicare covers many healthcare services, but it doesn’t cover everything. That’s where supplemental insurance comes in. Many seniors opt for Medigap, a supplemental insurance policy that helps cover the gaps left by Medicare, such as deductibles, copayments, and coinsurance. It's essential to review the different Medigap plans to determine which one offers the best coverage for your healthcare needs.

3.Long-Term Care Insurance

Long-term care (LTC) is another area that many seniors overlook in their retirement planning. Medicare does not cover long-term care, such as nursing home stays or home health care for chronic conditions. A separate long-term care insurance policy can help cover these significant expenses, ensuring that you’re not burdened with high out-of-pocket costs if you require long-term care.

4.Personal Savings and Health Savings Accounts (HSA)

In addition to Medicare and supplemental insurance, it’s wise to consider setting aside personal savings specifically for healthcare needs. A Health Savings Account (HSA) allows you to save money tax-free for healthcare expenses, and if you’re 65 or older, you can use these funds for non-medical expenses without penalty. This savings cushion will provide peace of mind in the event that unexpected medical costs arise.

How to Adjust Your Retirement Plans to Address Medicare’s Financial Challenges

Now that we’ve outlined some important factors to consider, let’s look at practical steps you can take to adjust your retirement plan to address Medicare’s financial challenges:

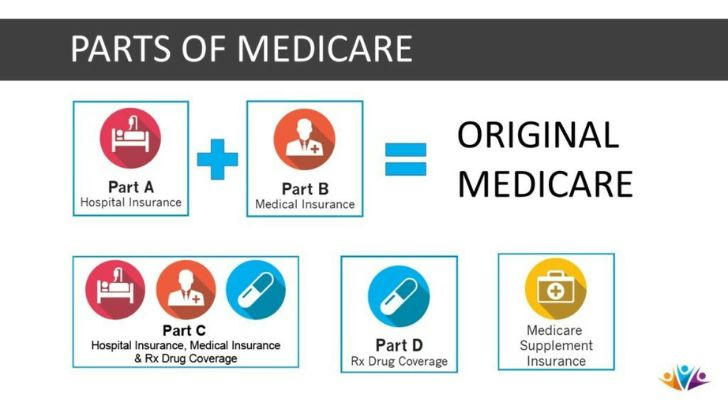

1.Understand the Different Medicare Plans

Medicare has four parts: Part A (Hospital Insurance), Part B (Medical Insurance), Part C (Medicare Advantage), and Part D (Prescription Drug Coverage). Each part provides different benefits, and understanding what’s covered under each can help you make informed decisions. If you’re uncertain which plans are best for you, it might be helpful to talk to a licensed insurance agent who can guide you based on your specific health needs.

2.Consider Medigap Coverage

While Medicare provides a great deal of coverage, it doesn’t cover everything. That’s where Medigap insurance comes in. Medigap policies help cover out-of-pocket costs like copayments and deductibles. Take the time to compare different Medigap plans, as they vary in coverage and cost. Choosing the right plan can reduce your financial burden and fill in gaps left by Medicare.

3.Prepare for Long-Term Care Needs

Long-term care is an essential aspect of healthcare that Medicare doesn’t cover. As you plan for retirement, consider purchasing long-term care insurance to ensure that you can receive care if needed. Long-term care insurance can help cover nursing home stays, assisted living facilities, and home health care, protecting you from the potentially high cost of extended care.

4.Build Your Savings

Saving for healthcare costs is crucial. While Medicare and insurance can cover many expenses, you may still need to pay out of pocket for certain services. Start setting aside funds for these potential costs, either through an HSA or regular retirement savings accounts. Having additional savings will provide a financial buffer in case you experience unexpected medical expenses.

5.Delay Social Security for Extra Income

Social Security can be a significant source of income during retirement, but you can increase your monthly benefit by delaying your Social Security payments. While the standard age for receiving Social Security is 66 or 67, you can delay it until age 70 to maximize your monthly payments. This extra income can help cover the rising costs of healthcare as you age.

Real-Life Case Studies: How Some Seniors Are Adjusting Their Plans

Case 1:

Mary, a 68-year-old retiree, found that while Medicare covered much of her healthcare, there were still significant out-of-pocket costs for prescriptions and specialist visits. After reviewing her options, she decided to enroll in a Medigap policy, which helped cover these costs. Additionally, Mary had been contributing to an HSA throughout her working years, which provided her with additional funds to cover unexpected medical expenses.

Case 2:

John, a 72-year-old with diabetes, knew that managing his condition would require ongoing care. He decided to purchase long-term care insurance to cover potential future needs. This policy provided him with the security of knowing that, if his condition worsened, he would have the financial support to cover the cost of nursing home care or home health care.

Final Thoughts: Planning Ahead for a Secure Healthcare Future

Medicare’s financial challenges mean that seniors need to be more proactive than ever when planning for retirement. By understanding the limitations of Medicare, considering additional insurance options like Medigap and long-term care insurance, and building personal savings, seniors can ensure they have the resources to cover their healthcare needs in retirement. The key is to plan ahead and adjust your strategy as needed, so you can face the future with confidence and peace of mind.